Normal file size for a QuickBooks company file – Pro Premier Enterprise Solutions

- Pro : 10mb – 50mb

- Premier: 50mb – 300mb

- Enterprise Solutions: 300mb and up

[wpedon id=”615″ align=”center”]

Buy QuickBooks Enhanced Payroll and Save

Normal file size for a QuickBooks company file – Pro Premier Enterprise Solutions

[wpedon id=”615″ align=”center”]

Buy QuickBooks Enhanced Payroll and Save

Change the time format (as Admin):

Change the date format:

To one you will need to change your settings in Windows (not in QuickBooks):

Windows 10

Windows 8

On your keyboard, press Windows key + E to open the Computer window.

Go to Settings > PC settings > Time and language.

In the Date and time section, click on Change date and time formats.

From there you can configure the following options:

First day of the week

Short date

Long date

For Windows 7

Open the Control Panel (icons view), and click on the Regional and Language Options icon, then close the Control Panel.

Under the Formats tab, select the format regional language that you want to use.

Change the date formats to how you want them displayed, and click on the Apply button.

NOTE: This will be for how the Short date, Long date, and First day of the week will be displayed as.

Click on the Additional Settings button.

NOTE: This will allow you to further customize the date format.

Click on the Date tab, and change the date formats to how you want them displayed.

When done, click on OK.

Click on OK again to finish.

[wpedon id=”615″ align=”center”]

Click the QuickBooks Help link, the link is for the latest version but be sure to click “change” to your version.

After Download & Update:

How to locate your license number

Get your product license emailed to you

Access Manuals and User Guides

Install Help:

Moving your QuickBooks installation to another computer

Install and run multiple version & editions of QuickBooks on the same computer

Installing Quickbooks and configuring product for multi-user or network environment

Links to help for the most common installation errors

[wpedon id=”615″ align=”center”]

QuickBooks Desktop Pro, QuickBooks Desktop Premier, QuickBooks Desktop Accountant, QuickBooks Desktop Enterprise, QuickBooks Mac Desktop, QuickBooks Point of Sale

This QuickBooks article is helpful for:

1) If you have QuickBooks desktop QBD company file saved on computer hard drive or on external hard drive storage and you need to export that file to QuickBooks Online QBO. This means you have backup company file but no actual QuickBooks desktop program.

2) If you want to cancel QuickBooks Online QBO subscription, and need to export the company file to QuickBooks desktop QBD. This is a way to have a backup company file.

We can also help export or import into QuickBooks Online QBO.

If you want to move to QuickBooks (QBO and QBD), but not sure how to move your data, please call our consulting service at 858-798-5058 or email us at info@vpcontroller.com .

IMPORTANT: These links are only trials, so please don’t try to register these products because it won’t validate and you’ll be locked out.

If you need a QuickBooks Desktop trial to export or import into QuickBooks Online, you can download it here.

If you try to restore a file with a different region’s QuickBooks, it will not work.

Please ensure you are on the latest release of any version downloaded to ensure a smooth migration.

Already a Desktop customer and need to troubleshoot an issue? http://support.quickbooks.intuit.com/Support/ProductUpdates.aspx

QuickBooks Pro/Premier 2017 – 30-day trial

You need these minimum requirements on your system to install this trial.

This installation requires a reboot, so be sure you can close other programs before proceeding.

http://dlm2.download.intuit.com/akdlm/SBD/QuickBooks/2017/US_R1/QuickBooksPremier2017.exe

License number: 5756-3895-5371-772

Product number: 760-899

Trial Validation Code: 653934

Note: If you haven’t installed this product version previously, you may not need the validation code.

QuickBooks Enterprise Solutions 17.0 – 30-day trial

Do not use this for converting your file to QuickBooks Online unless you only have an Enterprise Solutions file.

You need these minimum requirements on your system to install this trial.

This trial link doesn’t require license and product information, and will automatically install without it.

http://http-download.intuit.com/http.intuit/Downloads/2017/Latest/Setup_QuickBooksEnterprise17Trial.exe

QuickBooks for Mac – 30 Day Trial

The QuickBooks for Mac 2016 trial can be found here:

http://intuit.me/1LEuYn0

Canada QuickBooks Trials

Already a Desktop customer and need to troubleshoot an issue? http://support.intuit.ca/quickbooks/en-ca/iq/Update-QuickBooks/Update-QuickBooks-Desktop/HOW15427.html

QuickBooks Pro/Premier 2016 – 30-day trial

These are trial versions and will not validate if you try to register them.

Pro Trial

Premier Trial

Premier Accountant Trial

For trial links for other years, go to http://support.intuit.ca/quickbooks/en-ca/iq/Install–Update-and-Convert/Install-QuickBooks-from-a-download/HOW15493.html

United Kingdom QuickBooks Trials

Already a Desktop customer and need to troubleshoot an issue? https://community.intuit.com/questions/1339022-manually-updating-quickbooks-uk

QuickBooks Pro/Premier 2015 – 30-day trial

These are trial versions and will not validate if you try to register them.

Pro Trial Version

Premier Trial Version

Here’s how you can find an assembly build transaction and then print (see sample screenshot below).

From the Home Page:

[wpedon id=”615″ align=”center”]

How to track Job Time Costs for LLC members/owners that are not Employees? They are not on the payroll so they cannot enter time worked to jobs. But it is important to see how profitable the jobs are.

The idea here is to create a Zero-Journal bill to allocate time and effort to jobs without impacting on P&L report.

QuickBooks Setup (one-time)

In your QuickBooks chart of accounts create the following new accounts:

GO to Lists menu > Chart of Accounts > Account > select New

Image # 1

Image # 2

Service Item Setup

GO to Lists menu > Item List > Item > New > select Service

Image # 3

Enter Zero-Journal Bill for Owner’s Time Allocation

GO to Vendors menu and Select “Enter Bills”

Image # 4

Image # 5

Image # 6

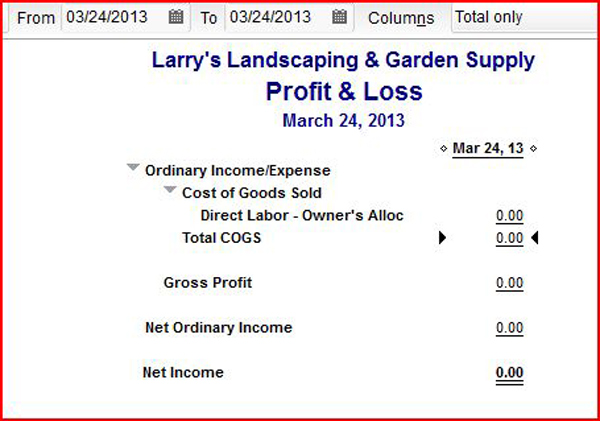

Now, let’s look at the various reports what will they turn out.

Image # 7

Image # 8

The big test is to see how it will come out in the Profit and Loss Report. See Image # 9 below. It shows no impact to P&L, and it zeroes out. It worked!

Image # 9

Please note that you should always run this past your CPA or Tax advisor to confirm it meets your needs, as we are not financial experts.

You must be logged in to post a comment.