.@xero Try it for free

http://wp.me/P4JhXc-eh

Author: admin

My computer crashed. Need to download the QuickBooks again. Where do I go for that?

Click the QuickBooks Help link, the link is for the latest version but be sure to click “change” to your version.

After Download & Update:

How to locate your license number

Get your product license emailed to you

Access Manuals and User Guides

Install Help:

Moving your QuickBooks installation to another computer

Install and run multiple version & editions of QuickBooks on the same computer

Installing Quickbooks and configuring product for multi-user or network environment

Links to help for the most common installation errors

[wpedon id=”615″ align=”center”]

QuickBooks Desktop Pro, QuickBooks Desktop Premier, QuickBooks Desktop Accountant, QuickBooks Desktop Enterprise, QuickBooks Mac Desktop, QuickBooks Point of Sale

This QuickBooks article is helpful for:

1) If you have QuickBooks desktop QBD company file saved on computer hard drive or on external hard drive storage and you need to export that file to QuickBooks Online QBO. This means you have backup company file but no actual QuickBooks desktop program.

2) If you want to cancel QuickBooks Online QBO subscription, and need to export the company file to QuickBooks desktop QBD. This is a way to have a backup company file.

Our Quickbooks Data Conversion Services

We can also help export or import into QuickBooks Online QBO.

If you want to move to QuickBooks (QBO and QBD), but not sure how to move your data, please call our consulting service at 858-798-5058 or email us at info@vpcontroller.com .

IMPORTANT: These links are only trials, so please don’t try to register these products because it won’t validate and you’ll be locked out.

If you need a QuickBooks Desktop trial to export or import into QuickBooks Online, you can download it here.

If you try to restore a file with a different region’s QuickBooks, it will not work.

Please ensure you are on the latest release of any version downloaded to ensure a smooth migration.

Already a Desktop customer and need to troubleshoot an issue? http://support.quickbooks.intuit.com/Support/ProductUpdates.aspx

QuickBooks Pro/Premier 2017 – 30-day trial

You need these minimum requirements on your system to install this trial.

This installation requires a reboot, so be sure you can close other programs before proceeding.

http://dlm2.download.intuit.com/akdlm/SBD/QuickBooks/2017/US_R1/QuickBooksPremier2017.exe

License number: 5756-3895-5371-772

Product number: 760-899

Trial Validation Code: 653934

Note: If you haven’t installed this product version previously, you may not need the validation code.

QuickBooks Enterprise Solutions 17.0 – 30-day trial

Do not use this for converting your file to QuickBooks Online unless you only have an Enterprise Solutions file.

You need these minimum requirements on your system to install this trial.

This trial link doesn’t require license and product information, and will automatically install without it.

http://http-download.intuit.com/http.intuit/Downloads/2017/Latest/Setup_QuickBooksEnterprise17Trial.exe

QuickBooks for Mac – 30 Day Trial

The QuickBooks for Mac 2016 trial can be found here:

http://intuit.me/1LEuYn0

Canada QuickBooks Trials

Already a Desktop customer and need to troubleshoot an issue? http://support.intuit.ca/quickbooks/en-ca/iq/Update-QuickBooks/Update-QuickBooks-Desktop/HOW15427.html

QuickBooks Pro/Premier 2016 – 30-day trial

These are trial versions and will not validate if you try to register them.

Pro Trial

Premier Trial

Premier Accountant Trial

For trial links for other years, go to http://support.intuit.ca/quickbooks/en-ca/iq/Install–Update-and-Convert/Install-QuickBooks-from-a-download/HOW15493.html

United Kingdom QuickBooks Trials

Already a Desktop customer and need to troubleshoot an issue? https://community.intuit.com/questions/1339022-manually-updating-quickbooks-uk

QuickBooks Pro/Premier 2015 – 30-day trial

These are trial versions and will not validate if you try to register them.

Pro Trial Version

Premier Trial Version

Here’s how you can find an assembly build transaction and then print (see sample screenshot below).

From the Home Page:

- Go to Edit, then select Find.

- Click the Advanced tab.

- In the Choose Filter section, select Transaction Type in the Filter list.

- Click the Transaction Type drop-down arrow and click Build Assembly.

- Click Find.

- Click Report.

- Click Print.

[wpedon id=”615″ align=”center”]

How to track Job Time Costs for LLC members/owners that are not Employees? They are not on the payroll so they cannot enter time worked to jobs. But it is important to see how profitable the jobs are.

The idea here is to create a Zero-Journal bill to allocate time and effort to jobs without impacting on P&L report.

QuickBooks Setup (one-time)

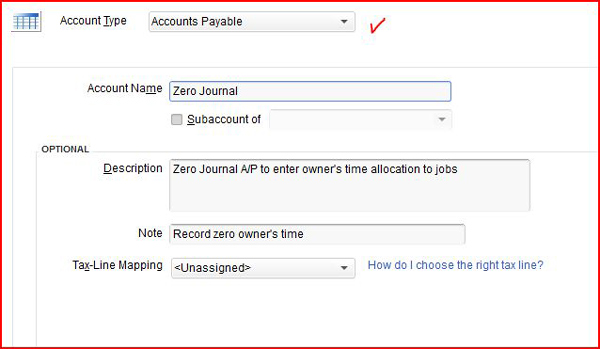

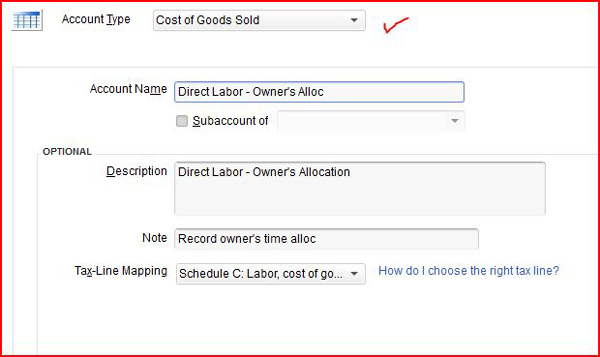

In your QuickBooks chart of accounts create the following new accounts:

GO to Lists menu > Chart of Accounts > Account > select New

- Zero Journal (under Accounts Payable – this is to differentiate this from operational Accounts Payable). Refer to Image # 1 for setup screen.

- Direct Labor – Owner’s Allocation (under COGS). Refer to Image # 2 for setup screen.

Image # 1

Image # 2

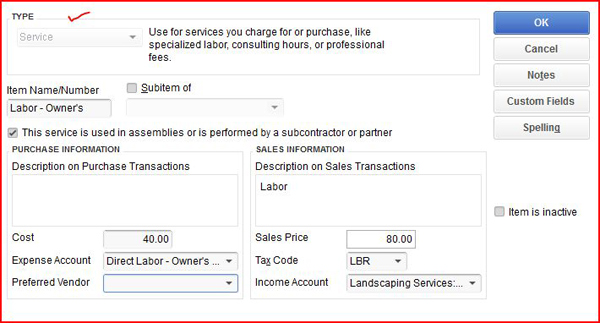

Service Item Setup

GO to Lists menu > Item List > Item > New > select Service

- Type = Service

- Item Name/Number = Labor – Owner’s

- Check the box > This service is used in assemblies or is performed by a subcontractor or partner

- Description = Leave it blank (if you put anything here, it will show up in job cost reports as lengthy unnecessary title/description)

- Sales = Labor (anything you like to see in your invoice as description)

- Cost = Hourly Rate (say $40 per hour for this example)

- Expense Account = Direct Labor – Owner’s Alloc (under COGS)

- Sales Price = Marked Up Hourly Billing Rate (say $80 for hour for this example)

- Tax Code = Non-Taxable Labor

- Income Account = Job Labor (title for income account)

- Refer to Image # 3 for setup screen.

Image # 3

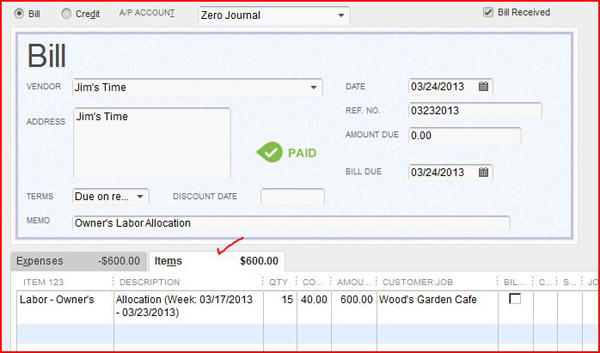

Enter Zero-Journal Bill for Owner’s Time Allocation

GO to Vendors menu and Select “Enter Bills”

- Have a Weekly (or Bi-Weekly) Timesheet ready

- Select Zero-Journal (NOT regular A/P)

- Vendors = Owner’s Name (setup as Other Name)

- Reference No. = Ending period of timesheet covered

- Select Items tab

- Select Labor = Owner’s from Item List (Service Type)

- Description = Timesheet work period

- Qty = Hours worked

- Cost and Amount should automatically calculate (hourly rate was already setup as $40 per hour in this example)

- Customer: Job = select Customer’s Name from Customer/Job

- Billable = check billable box if it’s actually billable to commercial customer (optional)

- Refer to Image # 4 for entry screen

Image # 4

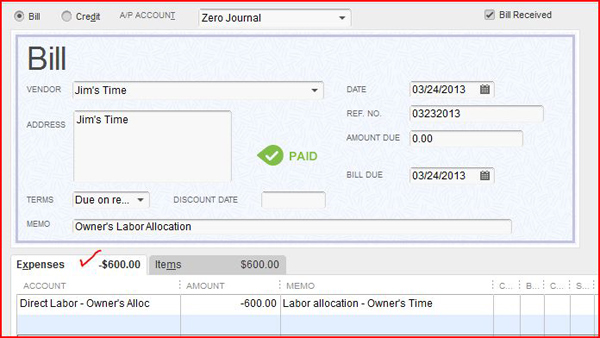

- Select Expenses Tab

- Account = Direct Labor – Owner’s Alloc (COGS account type)

- Amount = Enter negative amount (in this example -600.00)

- Memo = Labor allocation – Owner’s Time

- Refer to Image # 5 for entry screen

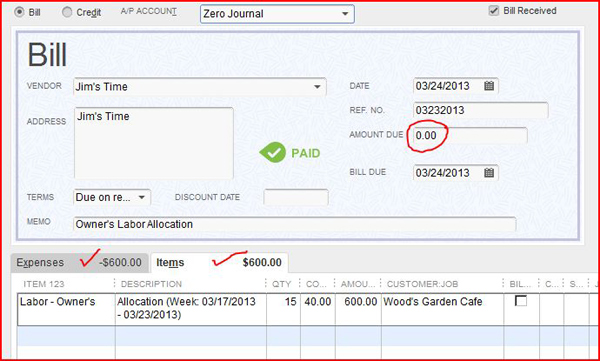

- Notice Expenses Tab & Items Tab

- Should see negative amount (-$600.00 in this example) for Expense Tab

- Should see positive amount ($600.00 in this example) for Items Tab

- The net impact is zero journal entry with no impact to Profit & Loss account.

- Refer to Image # 6 for entry screen

Image # 5

Image # 6

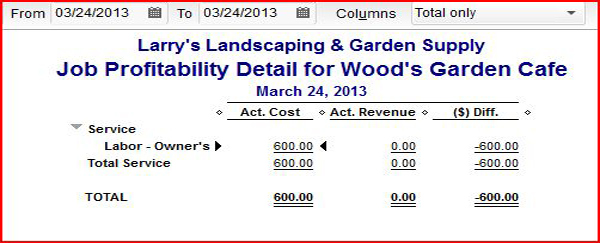

Now, let’s look at the various reports what will they turn out.

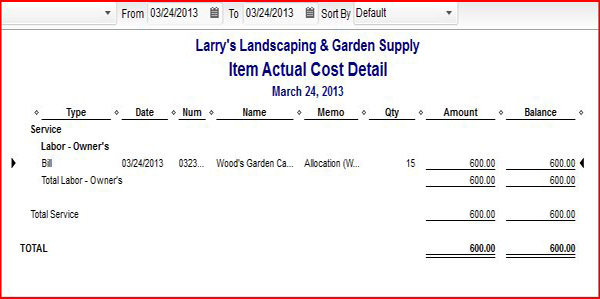

- Job Profitability Detail Report & Item Actual Cost Detail Report for this Job

- GO to Reports menu > Job, Time & Mileage > select Job Profitability Detail > select Customer

- Refer to Image # 7 for report screen

- Will reflect Owner’s cost of labor allocation for this job

- Double click actual cost dollar amount, it will take you to Item Actual Cost Detail Report. It will give detailed costs all the bill items entered for this job. Refer to Image # 8 for report screen

Image # 7

Image # 8

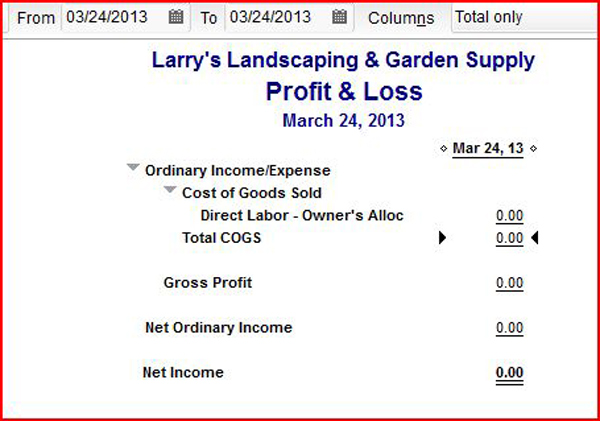

The big test is to see how it will come out in the Profit and Loss Report. See Image # 9 below. It shows no impact to P&L, and it zeroes out. It worked!

Image # 9

Please note that you should always run this past your CPA or Tax advisor to confirm it meets your needs, as we are not financial experts.

QuickBooks Desktop 2017 – New Feature Demo Tour (3:31 mins)

QuickBooks Desktop Pro Premier for Beginners – learn how to use QuickBooks bank feeds (30 mins)

[wpedon id=”615″ align=”center”]

Contact us for Consulting Help

All users who have the “Credit Card Protection” feature on, or whose QuickBooks Desktop file contains sensitive data such as credit card data or PII will be asked to set up a password to verify that the person attempting to access the account is authorized to view such data.

QuickBooks Desktop detects the presence of the following data to ensure strong controls:

- Employee and Employer Social Insurance Number

- Employer Bank Details (Routing Number, Account Number)

- CRA Business Number

Find out more about our security update here.

[wpedon id=”615″ align=”left”]

You must be logged in to post a comment.